Growing teams have both increasing budgets and expenses. As your responsibilities and headcount increases, you need to utilize the right tools to organize and control your business finances and people ops.

From tracking employees and contractors, to automating payroll, these tools can alleviate your growing pains and better manage your finances across the entire team.

I’ve encountered many of these tools personally from working with various startup clients and freelancers. Most are all-encompassing solutions, but I’ve grouped them according to the primary functions I’ve used them for the most often.

Finance management

1) Airbase

Airbase offers companies an all-in-one spend management platform that handles non-payroll payables. For small to midsize companies, they provide finance teams with:

- Greater control and visibility over safe, seamless purchasing

- More time thanks to workflow automations

- Real-time reporting

Airbase streamlines overall spend management while delivering a solution that can scale with your company as it grows. The platform’s three key features take care of the following:

- Bill payments – Build invoice processing workflows, make ACH, check, and international payments to 200 countries, and more.

- Corporate cards – You can apply for secure physical and virtual Airbase cards with improved spend controls, as well as enjoy market-leading cash back rates.

- Reimbursements – Airbase’s mobile app for requests and approvals lets you submit reimbursements anytime, anywhere. Automated workflows also optimize the process and eliminate the need for expense reports.

I have used Airbase personally to invoice clients and accept payments.

2) Bill.com

Bill.com provides accounts payable (AP) and accounts receivable (AR) automations for small to midsize companies in various industries like hospitality, healthcare, and more. Their solutions take care of:

- Payments – Make easy and secure ACH, card, international, and Bill.com network payments to your vendors.

- Approvals – Streamline your AP approval process with stronger control and security using custom policies that fit your business.

- Controls – Tailored user roles, permissions, and approvals offer greater control; vendor info and document storage alongside approval and payment status tracking expand AP workflow visibility; and single sign-on and audit trails improve safety.

- Invoicing – Easily create, send, and manage customized invoices to save time.

- APIs – Build your own custom integration, which lets you use appropriate automations for your current tech stack to produce a branded experience for your payment portal.

On a side note, Bill.com also provides an all-in-one expense management solution through their company, Divvy.

I have used Bill.com personally to get automatically recurring retainer payments from a client.

3) Brex

Brex’s Empower platform provides companies with a slew of spend management features that are designed to help your company spend smarter and move faster. Their innovations help you oversee:

- Budgets – You can create flexible, pre-approved budgets for your employees and manage them easily through rules and policies. Both Brex’s dashboard and mobile app also allow employees to select or update various budgets and draw from them with a single card.

- Expenses and reimbursements – Empower makes it easy to manage and process repayments, expenses, and reimbursements. It also offers automations for travel receipts and bill payments.

- Integrations and APIs – The platform boasts thousands of integrations and extended API support so you and your team can implement it seamlessly with your existing systems.

- Global capabilities – Empower lets you monitor and manage your spend globally. Its cards work in more than 100 countries, each having unique chips and PINs. You can also carry out worldwide reimbursements and view foreign exchange rates.

Besides the Empower platform, Brex also offers various products ranging from business accounts to their financial modeling tool, Pry.

I have used Brex personally to pay marketing department expenses on behalf of a client.

4) FreshBooks

FreshBooks is a convenient accounting tool that can be used to send and manage invoices, receive payments, and track expenses. Some of their features include:

- Professional invoicing that you can customize with your branding

- Expense reporting and reimbursement tracking

- Automated payment options for retainer clients

- Double-entry accounting tools to stay on top of taxes

I have used FreshBooks personally to pay a freelancer.

5) Ramp

Note: I no longer recommend Ramp due to techical difficulties that resulted in a client paying my retainer into an old account. Vendor portal access wasn’t available, so my client sent a new request for payment details, which I filled out and saved, and then my client confirmed my information was updated. Their next payment still went into the former account, which I no longer had access to.

Ramp’s award-winning software automates financial management for companies, saving them both time and money. It handles four key elements:

- Cards – Use unlimited branded physical and virtual cards that are instantly available and accepted everywhere. Ramp also offers unlimited 1.5% cash back, zero fees, Visa benefits and fraud protection, and mobile-ready functionality.

- Expenses – Digitized approval policies and spend guidelines automate expense processing. Ramp also lets you process real-time transactions, collect receipts instantly, and match crumpled, blurry, or receipts in foreign currencies through its advanced AI.

- Bills payments – AI lets you process hundreds of invoices in seconds and pay your vendors via card, ACH, or check. You can also create approval policies and onboard vendors.

- Accounting – Ramp’s software allows you to manage data across your cards, bills, and reimbursements. What’s more, their integrations and automations let you maintain accurate, up-to-date books that close on time with less effort.

People operations

1) Pilot

Pilot provides companies an all-in-one HR solution divided into two key functions. First, their Core Platform lets you onboard and manage your global team members in one place through features such as:

- Guided onboarding – This makes the process faster and easy to understand for you and your new hires.

- Smart contract workflows – Intelligent workflows let you safely store and track your contracts, keeping them up to date for you and your team. They also support e-signatures.

- HR data and custom reports – Store team data securely in one location and create custom reports for in-depth insights, eliminating the need for physical documents.

The second key function, their Payroll feature, lets you run payroll for any type of worker across over 240 countries, including the U.S., like:

- Domestic W2 employees

- International employees

- Global contractors

You can automate custom payroll flows and payments, all with secure processing. Pilot streamlines multiple HR functions, from onboarding, benefits, and compliance to payrolls.

I have used Pilot personally to invoice clients and accept payments.

2) Rippling

Rippling’s platforms are designed to eliminate the administrative work involved with running a company. Their Unified Workforce Management Platform tackles three core functions — HR, IT, and finance — through the following features:

- Workflow automation – Automate manual HR, IT, and financial processes across multiple systems through custom logic. Workflow triggers use employee data while pre-built workflow templates simplify their setup.

- Policy management – This lets you design and enforce your company’s HR, IT, and financial policies, which integrate across all of your systems.

- Workforce analytics – Unified reporting lets you analyze your reconciled workforce data for every business system.

- Access management – Manage permissions and approvals, controlling the apps and data your employees can access for each of your systems.

Rippling also has separate platforms for HR and IT. Here’s a brief overview of both solutions:

- HR Cloud – This software handles payroll, benefits, time and attendance, training and compliance, talent recruitment and development, and PEO services.

- IT Cloud – This platform handles both app management and device management. It securely connects employees with your apps and lets you set up, secure, and manage your staff’s computers.

I have used Rippling personally to monitor team work anniversaries and birthdays, manage contractors, and get paid an automatic monthly retainer from a client.

3) Remote

Remote’s platform streamlines HR for businesses of all sizes through automations. It helps you build a global workforce through the following features and services:

- Hire employees – Enjoy personalized service from Remote’s HR and legal experts to handle international payroll, benefits, taxes, and compliance for workers in any country with ease.

- Hire international contractors – This intuitive platform lets you onboard, manage, and pay contractors worldwide — all with contracts tailored to local labor laws.

- Run global payroll – Consolidated processing lets you manage your payroll, taxes, benefits, and compliance for all your employees. Your global contractor payments, employer of record services, and payroll management are also unified within Remote.

- Offer benefits – A combination of automations and expert advice lets you easily administer country-specific and compliant benefits packages with competitive rates, no matter where your employees are located.

- Offer stock options – Remote’s equity experts will guide you through equity planning and tax withholding and reporting. They provide detailed, country-specific guidance and ensure compliant withholding and reporting when taxable events happen.

- Expand globally – Remote takes on your employer liability, owns entities in the locations they serve, offers global IP protection, and provides expert support for your expansion.

4) Gusto

Gusto is an HR platform that uses smart technology to streamline workflows for running payroll, administering benefits, and more. It simplifies the following business aspects:

- Payroll – The platform features automations for filing taxes with built-in time tracking and benefits. Users also have access to Gusto’s customer service for troubleshooting.

- Employee benefits – Build affordable health and financial benefits packages for your team.

- Hiring and onboarding – You can create public job posts, personalized offer letters, and onboarding checklists for new hires. Additionally, software provisioning lets you set up tools for your team, along with integrations for applicant tracking programs.

- Time tools – Gusto provides time tracking for your employees and projects. You can also customize PTO policies and run detailed reports to manage your team’s time off.

Besides these key HR functions, Gusto also furnishes your business with other useful services and technology, including:

- HR experts – Receive professional support whenever you need it.

- Gusto Wallet – This free employee app lets them track their savings and spending.

5) BambooHR

BambooHR’s award-winning software is designed to streamline and bolster HR for small and medium-sized businesses. To support your people and improve the employee experience, it focuses on five pillars:

- Personnel data and analytics – Access all your employee information through a single database, as well as robust reporting tools. You can also create custom workflows and approval processes for easier decision-making.

- Hiring – With applicant tracking tools, you’ll be able to streamline and monitor each stage of your hiring process, from candidate applications to offer letters.

- Onboarding – The software’s customizable templates and onboarding checklists let you add a personal touch to your process while speeding up any formalities and reducing compliance concerns. It also supports e-signatures and facilitates easier offboarding.

- Compensation – BambooHR can easily track time, benefits, and PTO, making payroll easier.

- Culture – The company’s performance management software and eNPS surveys help you measure employee performance and satisfaction, revealing insights that can strengthen your business culture.

6) Oyster

Oyster is a global employment platform that provides the necessary tools to recruit, hire, and maintain a globally distributed team. They enable this through five key solutions:

- Global employment – Tools to hire and pay international employees in compliance with local ordinances.

- Global contractors – Streamline the paperwork and processes to working with international contractors.

- Contractor conversion – Find the best contractors and bring them on-board full-time with risk assessments.

- Global payroll – Pay your people in their preferred currency with competitive exchange rates and streamlined invoicing.

- Localized benefits and rewards – Incentivize and motivate teams no matter where they are with relevant health coverage and other benefits.

Bonus: Freelancer tools

As an extra benefit, here are some tools that help self-employed individuals run their businesses effectively.

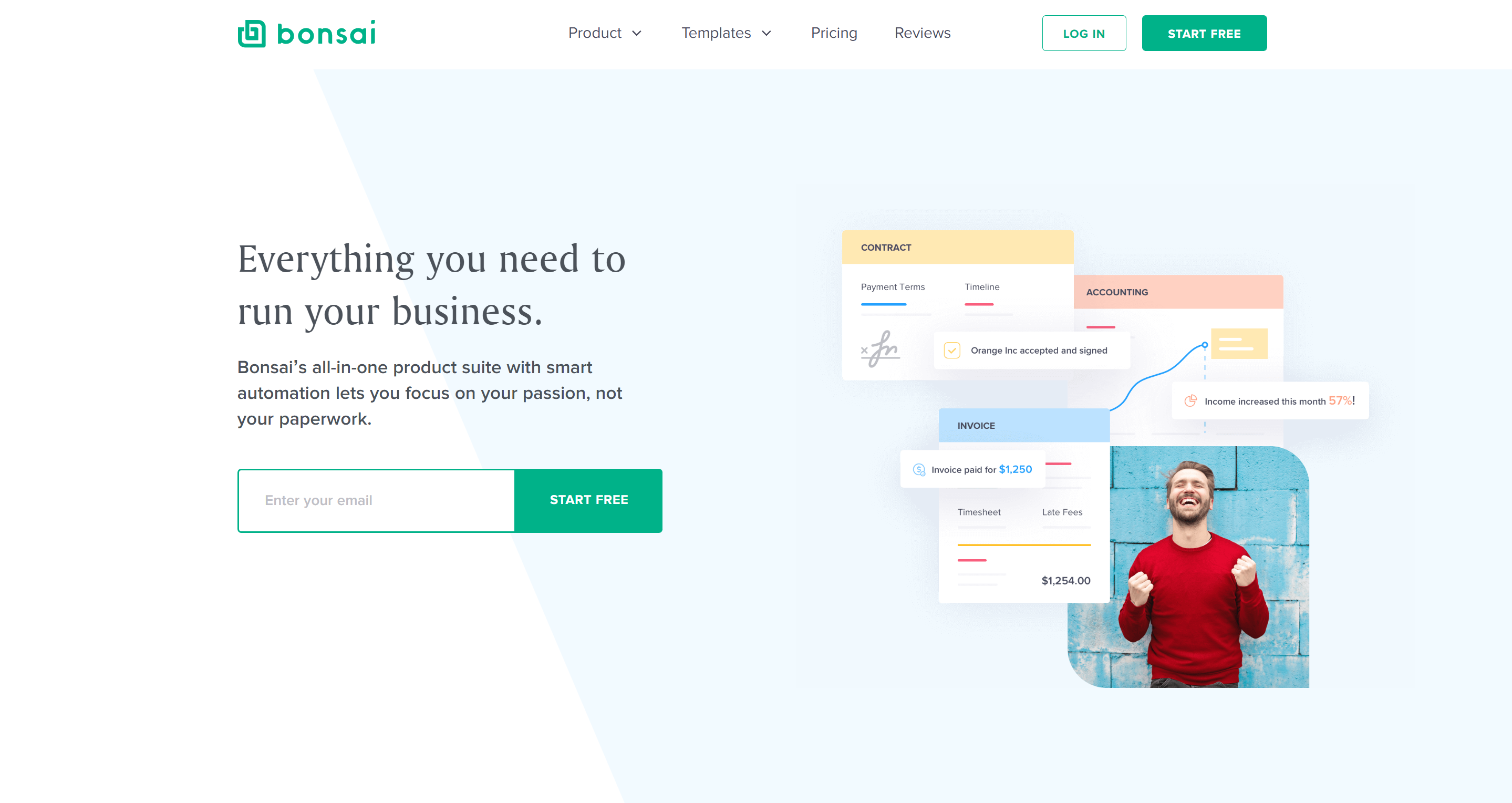

1) Bonsai

Bonsai provides an all-in-one package with automations designed to help freelancers operate smoothly. It’s composed of three main products, which we’ll cover briefly.

Bonsai Workflow

This product lets freelancers manage their business in one place. Its features cover many facets such as:

- Invoicing and payments, which are streamlined through automations

- Proposals, which are customizable through Bonsai’s online proposal maker

- Contracts that users can easily generate through customizable templates with e-signature support

- Custom forms and questionnaires that let you increase client intake and automate feedback

- A client CRM that allows you to add leads, manage clients, and track projects with ease

- A time tracker, along with automated timesheets and billing systems, which helps you stay organized

- Accounting reports that monitor and manage income, expenses, and taxes

- Project templates and integrated timesheets that make task management effortless

Bonsai Tax

Through automations and software, this tool helps freelancers track expenses, maximize tax write-offs, and estimate their quarterly taxes.

Bonsai Cash

Think of this as a bank account for freelancers that lets them pay for their business expenses in multiple ways, from any location. Through it, you can:

- Get a physical Bonsai card in a few days

- Generate a virtual card for your expenses

- Add your card to Apple Pay for easy payments

It also lets you manage your savings and expenses, as well as receive money faster.

I have used Bonsai personally to pay a freelancer.

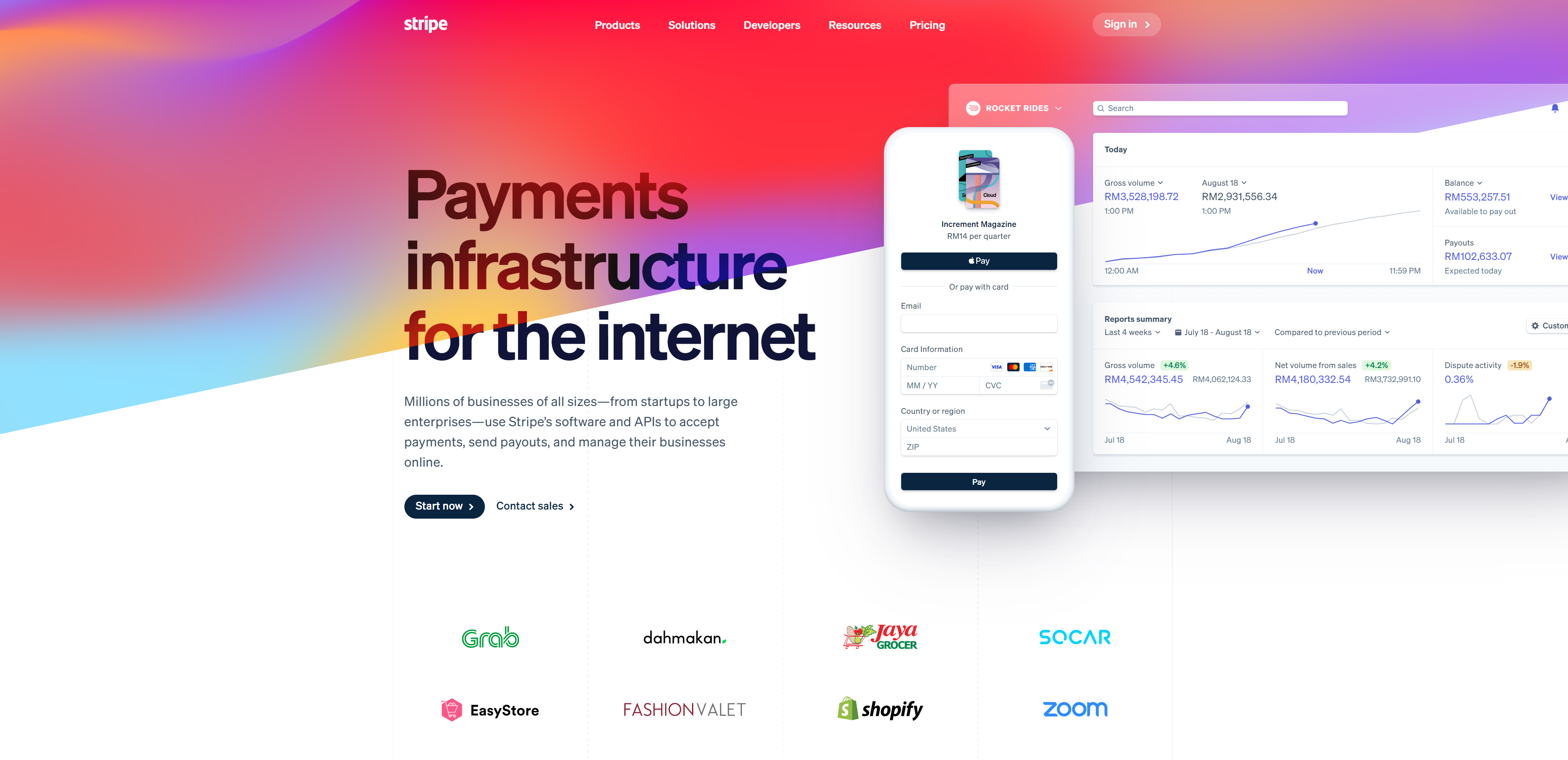

2) Stripe

With much lower fees than PayPal, Stripe is one of my favorite invoicing tools. As someone who regularly employs freelancers, I recognize their UI immediately as it’s super easy to simply enter my credit card details and click pay.

Stripe is a popular tool in eCommerce for merchants to accept secure payments, but for the purposes of freelancers they are great for:

- Online invoicing and receiving payments

- Integrating with other platforms to enable checkout

- Creating flexible payment schedules

- Refund management

- Reports and automatically-generated tax forms

I have used Stripe personally to pay a freelancer.

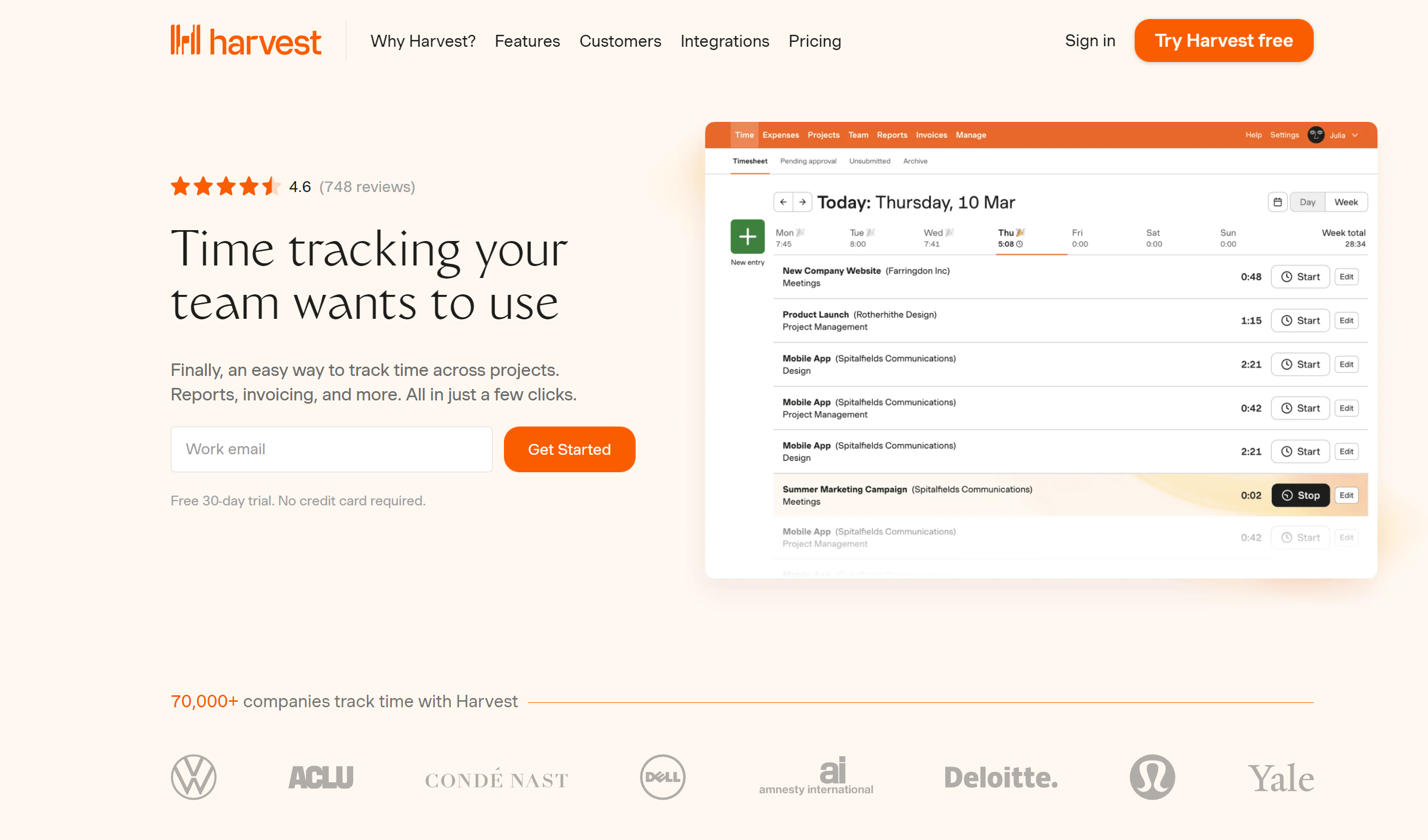

3) Harvest

Harvest is another of my favorite ways to receive invoices from freelancers. They are easy to pay, optionally come with timesheets attached, and it’s so easy to just enter my card details and click pay.

Harvest offers:

- Time tracking, their primary offering and what I previously discovered them for

- Reports that showcase time versus budget breakdowns and more

- Online invoicing and payment processing

I have used Harvest personally to pay a freelancer.

4) Harlow

Harlow’s management solution helps freelancers save time, stay organized, and maintain professionalism. With its automations, templates, and other features, it efficiently manages:

- Proposals and contracts – Take advantage of pre-built and customizable templates, send proposals directly through Harlow, track progress, and execute contracts with e-signatures.

- Invoicing – Automatically create invoices for ongoing clients or send late payment reminders to make invoicing flexible and easy.

- Client management – Harlow integrates with Google Workspace, which lets you view anything related to your customer such as meetings, tasks, and upcoming invoices.

- Task management – View tasks by client or project, track time spent on tasks, and create subtasks for easier management.

- Time tracking – Track time spent on clients, tasks, or projects and charge clients accurately.

Wrapping up — Embrace the right tools to run your business smoothly

Financial and personnel management can make or break your business. You need robust processes to maintain organization of these key aspects. Use the tools above to keep clean records of your finances, make it easy to get paid and pay your team, and streamline business operations.